Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehicle—let's say $8,000 to $10,000—is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car.

Our car loan calculator can do all the hard work for you. There are a lot of benefits to paying with cash for a car purchase, but that doesn't mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. It is up to each individual to determine which the right decision is.

Whether you buy new or used, it's wise to get pre-approved for a loan before you ever step on a car lot. Go to your bank or credit union and ask the agent if you qualify for a loan and how much. The agent will check your FICO credit score and other obligations and provide you with an amount and interest rate. The higher the score the lower the interest rate you will be offered. People with a bad credit history may pay interest rates that are more than double prime rates.

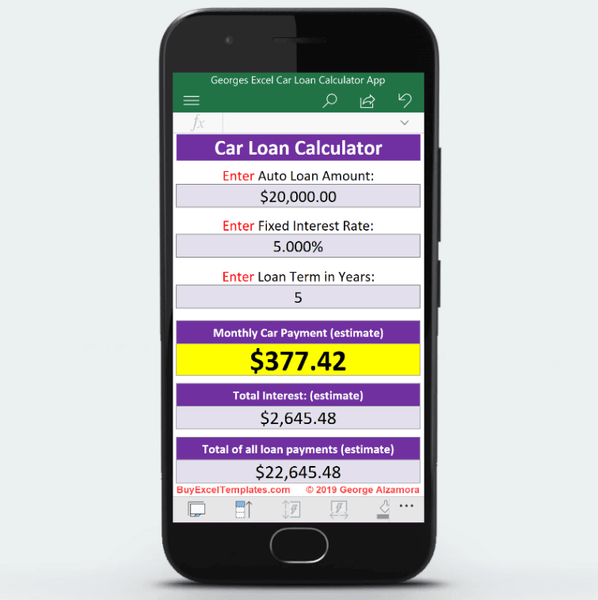

You can also shop for auto loans online if you aren't concerned about where your personal information goes. Armed with a pre-approved loan you are now in control and have a choice to go with dealer financing or stick with your bank, whichever rate is lower. The car loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation. Your loan term -- or the amount of time you'll be paying back the loan -- will impact the price of your monthly car payments.

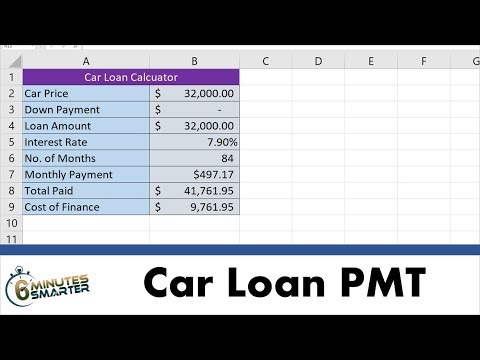

With a shorter-term auto loan, your monthly payments will be higher, but you will have a lower APR and pay less in interest in the long-run. Use the auto loan calculator to see the difference in monthly payments and interest paid depending on the term of the auto loan. You can make use of the Car Loan EMI calculator to estimate the amount you have to pay each month towards your car loan.

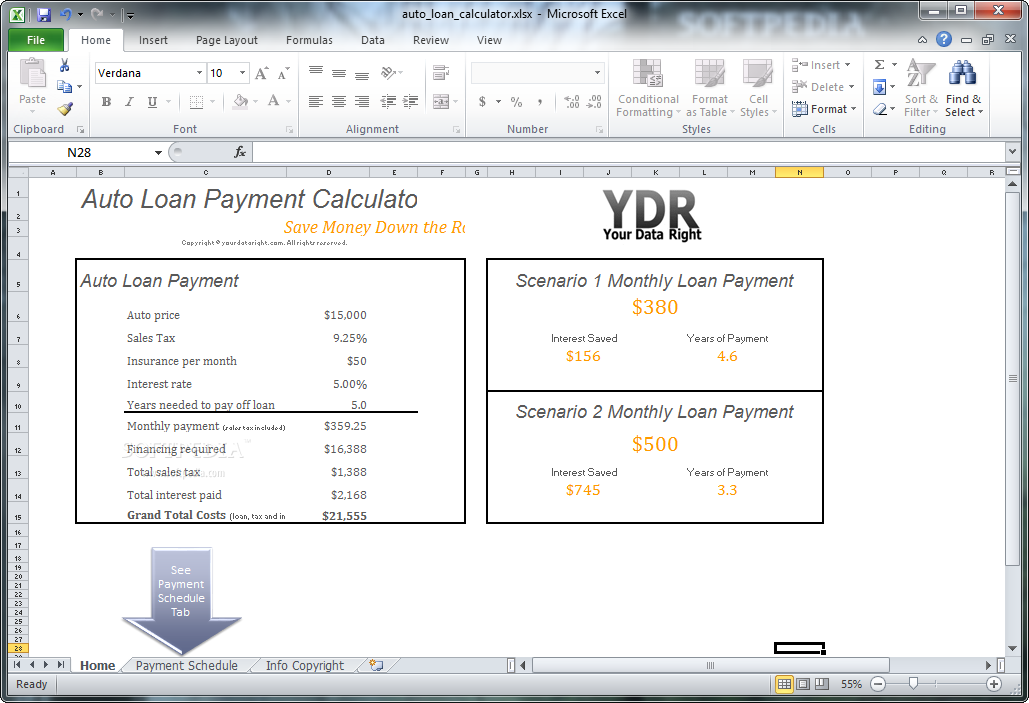

The best way to lower your vehicle payment is to put money down when you initiate the deal. For example, if you're buying a $20,000 vehicle, your auto loan would be for $20,000, plus whatever the interest is. But with a $4000 down payment, you'll only have to take out a $16,000 loan, plus interest. The benefit here, aside from a lower sale price, is that you will have lower monthly payments. Try using different down payments in the car loan calculator Canada! Use this calculator to help you determine your monthly car loan payment or your car purchase price.

After you have entered your current information, use the graph options to see how different loan terms or down payments can impact your monthly payment. You can also examine your complete amortization schedule by clicking on the "View Report" button. Many times dealerships will offer a choice of 0% financing or a factory rebate. Figure out the interest you would pay for the life of the loan if you financed with your bank. If the interest is more than the rebate, then take the 0% financing.

For instance, using our loan calculator, if you buy a $20,000 vehicle at 5% APR for 60 months the monthly payment would be $377.42 and you would pay $2,645.48 in interest. If the rebate is $1,000 it would be to your advantage to take the 0% financing because the $1,000 rebate is less than the $2,645.48 you would save in interest. Be aware though, that unless you have a good credit rating, you may not qualify for the 0% financing and this option may only be offered on selected models. People with poor credit are a major source of profits because they can be charged far higher interest rates.

Some "buy here, pay here" dealerships specifically focus on subprime borrowers. An auto loan calculator shows the total amount of interest you'll pay over the life of a loan. If the calculator offers an amortization schedule, you can see how much interest you'll pay each month. With most car loans, part of each payment goes toward the principal , and part goes toward interest.

APRs appearing in rate tables and/or calculator results are based on your input and are subject to change at any time. Additional terms and conditions apply such as vehicle age and mileage. Consider checking your credit report occasionally to be sure inaccuracies aren't impacting your ability to receive credit. Calculator results are also based on your selected dealer state, loan-to-value ratio of 100% and only apply to car purchases from a dealer in the Chase network. Apart from the auto loan EMI calculator, you can use another online tool known as the amortization calculator which allows you to understand your car loan payments at any given time. It shows how the loan progresses throughout its tenure including monthly payable EMIs, total interest paid, amounts overdue after each paid EMIs etc.

Bankrate's auto loan calculator will give you a good idea of how much car you can afford from a monthly payment standpoint. Start with a list of vehicles that you're interested in and estimated purchase prices. Then subtract the amount of money you can use for a down payment and an estimate of your current car's trade-in value.

Lastly, compare costs to make sure that the calculated auto loan payment based on the amount you need to borrow aligns with your monthly budget. Most people turn to auto loans during a vehicle purchase. They work as any generic, secured loan from a financial institution does with a typical term of 36, 60, 72, or 84 months in the U.S.

Each month, repayment of principal and interest must be made from borrowers to auto loan lenders. Money borrowed from a lender that isn't paid back can result in the car being legally repossessed. The factor that will change your monthly payment the most is the loan term. The longer your loan, the less you'll pay each month, because you're spreading out the loan amount over a greater number of months. However, due to the interest you'll be paying on your loan, you'll actually end up spending more for your vehicle by the time your payments are over.

Because the more time you spend paying off your loan, the more times you will be charged interest. As a business, a car loan may help you improve cash flow to your business as well as the potential to claim tax deductions if the car is being used for business purposes . Buying any new or used car can get overwhelming when you have no clue of where to begin from the money standpoint. One of the keys to a successful car purchase has always been being able to figure out what you can manage financially. So, to that end, use our car loan calculator to get an idea of what you can afford! All you have to do is plug in your desired monthly payment or your desired vehicle price.

Any calculation made by you using this Car Loan calculator is intended as a guide only. It is for illustrative purposes only and is based on the accuracy of the information provided. The calculator does not take establishment fees, stamp duty or other government charges into account. The amount you can borrow may vary once you complete a loan application and all the details relevant to our lending criteria are captured and verified.

The calculations should not be relied on for the purpose of making a decision whether to apply for a car loan. Use our auto loan calculator to estimate your monthly car loan payments. Enter a car price and adjust other factors as needed to see how changes affect your estimated payment. With our car loan calculator you'll see how much you can borrow for a used or new car and what you'll be paying over your set term.

Our calculators work out your interest automatically so you'll see your principal and interest amounts, including what you'll save with an extra repayment or two. Calculate your repayments on a monthly, fortnightly or weekly basis and plan for your future with a car loan from RACQ Bank. The auto loan calculator will display your estimated monthly auto payment. You will also see the total principal paid and the total interest paid. Add these two figures together to see the total amount you will pay for your new or used car over the life of the loan.

Secured loans like home loans and car loans, and unsecured loans like personal loans are repaid through Equated Monthly Installments . Car loan EMI is a fixed amount that the borrower pays to the lender/bank each month towards the repayment of the car loan till the end of the loan tenure. EMI consists of the principal loan amount and interest payment. If you're planning on financing your new vehicle purchase, the overall price of the vehicle isn't really the number you need to pay attention to.

Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal. Enter the amount you need to finance your car into the auto loan calculator. To calculate this, subtract your down payment and trade-in value amounts from your car's sticker price or MSRP. Enter a total loan amount into this auto loan calculator to estimate your monthly payment, or determine your loan amount by car price, trade-in value and other factors.

Use our car loan calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan. You won't fully own the car until you make the final personal contract purchase 'balloon' payment. A balloon payment is when you pay more at the end of your loan term than earlier monthly payments. It allows you to reduce your monthly fixed payment to an affordable amount by agreeing to pay more when your loan comes to an end. A new car comes with new costs to consider like gas and maintenance, but the most important one to account for is a new car loan payment.

Flagstar Bank's car loan payment calculator takes your vehicle data, trade-in information, and loan costs to create a personalized loan payoff schedule. Never worry about how to calculate monthly car payments ever again. Equated Monthly Installment - EMI for short - is the amount payable every month to the bank or any other financial institution until the loan amount is fully paid off.

It consists of the interest on loan as well as part of the principal amount to be repaid. The sum of principal amount and interest is divided by the tenure, i.e., number of months, in which the loan has to be repaid. The interest component of the EMI would be larger during the initial months and gradually reduce with each payment. The exact percentage allocated towards payment of the principal depends on the interest rate. Even though your monthly EMI payment won't change, the proportion of principal and interest components will change with time.

With each successive payment, you'll pay more towards the principal and less in interest. The Auto Loan Calculator is mainly intended for car purchases within the U.S. People outside the U.S. may still use the calculator, but please adjust accordingly. If only the monthly payment for any auto loan is given, use the Monthly Payments tab to calculate the actual vehicle purchase price and other auto loan information.

Many variables, including current market conditions, your credit history and down payment will affect your monthly payment and other terms. See your local dealer for actual pricing, annual percentage rate , monthly payment and other terms and special offers. Pricing and terms of any finance or lease transaction will be agreed upon by you and your dealer. Your monthly car payment is based on the loan amount, the loan term and the interest rate for the loan.

Loan amount is based on the net purchase price of the vehicle or the vehicle price less any cash rebate, trade-in or down payment. If you have an outstanding balance on the vehicle you trade-in, that amount is added to the price of the vehicle you are purchasing. The best way to get a lower auto loan interest rate is to improve your credit score.

If you have a low credit score, consider holding off on a car purchase until you can improve your score. You will get EMI as soon as you enter the required loan amount and the interest rate. Installment in EMI calculator is calculated on reducing balance. As per the rules of financing institutions, processing fee or possible charges may be applicable which are not shown in the EMI we calculate. Probably the most important strategy to get a great auto loan is to be well-prepared.

This means determining what is affordable before heading to a dealership first. Knowing what kind of vehicle is desired will make it easier to research and find the best deals to suit your individual needs. Once a particular make and model is chosen, it is generally useful to have some typical going rates in mind to enable effective negotiations with a car salesman. This includes talking to more than one lender and getting quotes from several different places. Getting a preapproval for an auto loan through direct lending can aid negotiations. A car purchase comes with costs other than the purchase price, the majority of which are fees that can normally be rolled into the financing of the auto loan or paid upfront.

However, car buyers with low credit scores might be forced into paying fees upfront. The following is a list of common fees associated with car purchases in the U.S. We offer financing options for new or used cars, SUVs, trucks, vans and recreational vehicles that are sold privately or through dealerships. Try our vehicle loan calculator to see how much your monthly payments could be. Use this calculator to help you determine the monthly loan payment for your car, truck, boat, RV or motorcycle.

Enter purchase price, monthly payment, down payment, term and interest rate to see how different loan terms or down payments can impact your monthly payment. Know that there isn't one "best" way to get the lowest monthly payment. It depends on your trade-in value, your credit history, your desired term, how much your willing to put down at the time of purchase, etc. If you're on a tighter budget, then choosing the lowest payment possible could be the best way to go.

However, if you're able to pay more each month, then you'll be able to take a shorter term and have your vehicle paid off faster . Adjust the loan amount and loan term length on the loan payment calculator to see how it impacts your monthly payments. Auto loans have a minimum loan term of 12 months and minimum loan amount of $5,000. Annual percentage rate is the cost you pay each year for financing - it includes finance charges, fees, and other charges.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.